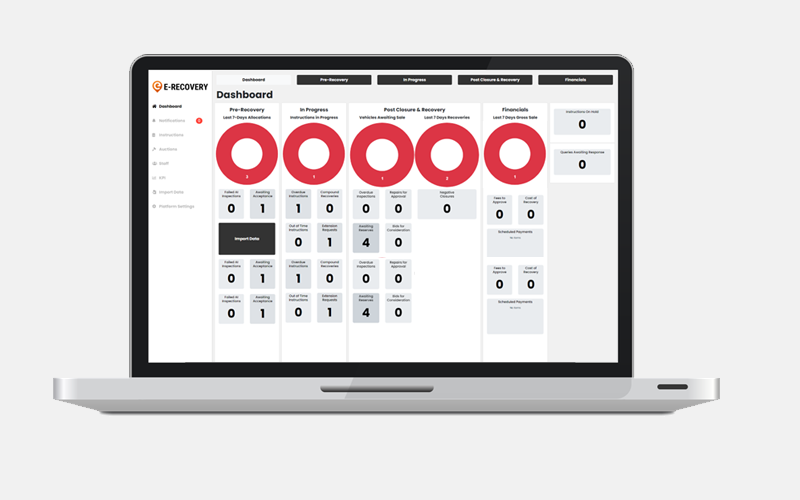

Dashboard-driven asset management

E-Recovery has been purpose-built to service the back-end recovery and remarketing requirements of motor finance organisations, providing a fully transparent end-to-end integrated umbrella management solution.

E-Recovery has been purpose-built to service the back-end recovery and remarketing requirements of motor finance organisations, providing a fully transparent end-to-end integrated umbrella management solution.

Spanning the critical pre-recovery/pre-termination journey through to post closure and remarketing, E-Recovery provides clients with a central panel management solution to handle any supplier type within a fully compliant, flexible and truly unique environment.

Throughout the development of E-Recovery, careful attention has been paid to ensure specific regulated and unregulated process are embedded within the fabric of the platform, removing the human element and risk associated with the same. From the initial set-up, allocation of responsibilities and visibility through to the suspension, E-Recovery provides a fully flexible approach under licence, with maximum focus on compliance.

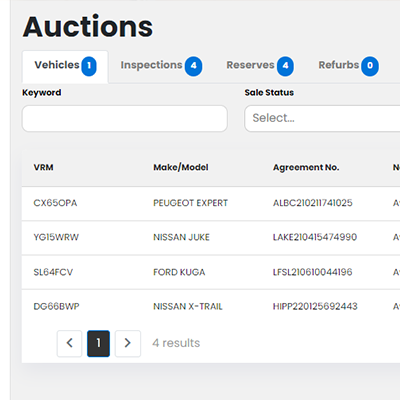

Data is key to everything within E-Recovery, simplifying detail into workflows and tabs. The web-based, highly configurable interface can be accessed securely either via desktop, laptop or mobile devices. Due to the unique architecture, the ability to link into 3rd party platforms is exceptionally efficient, using the latest web API technologies and our in-house development resource.

G3 are regulated and approved by the Financial Conduct Authority and the E-Recovery platform enables finance clients to manage key elements of the recovery and remarketing journey either in-house or via a partial or fully outsourced solution, whilst retaining full control of preferred suppliers and charges to deliver best-in-class service.

Client approved suppliers span all elements of the process from recovery agents through to remarketing partners. Retaining preferred suppliers with the ability to increase or reduce commercial volumes based on performance, fully managed by client specified system KPI’s.

Cradle to grave asset management for the Motor Finance trade. Manage all reconnect, hostile, voluntary termination and surrender allocations, capturing recovery information and expenditure, review successful and unsuccessful recoveries and associated closure reports, damage estimates and vehicle images, monitor remarketing processes, overaged stock and values, reconcile all sale proceeds and associated charges and finally, allow the data to drive future activity, allocations and ultimately develop a more cohesive strategy.

Join many of the UK’s largest asset finance providers in utilising our E-Recovery platform to manage your vehicles